TRX Price Prediction: How High Will TRX Go?

#TRX

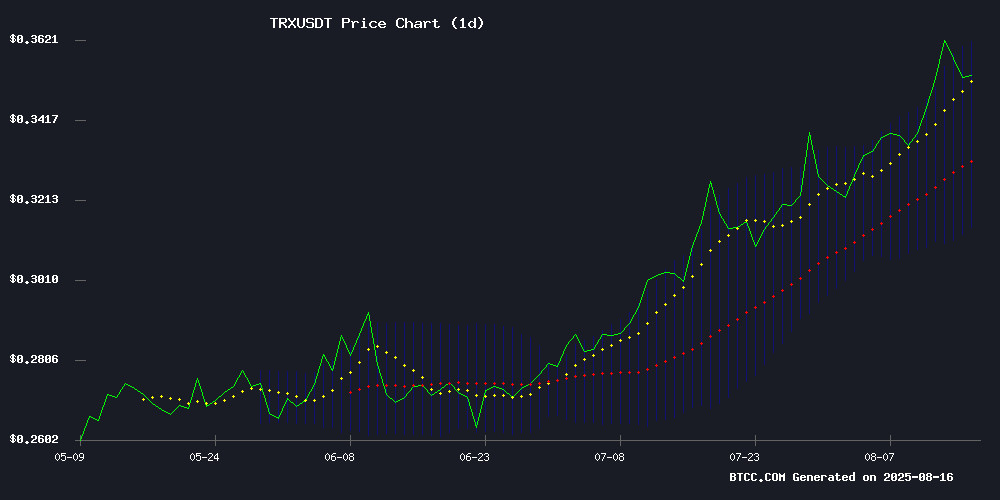

- TRX trades above its 20-day MA, signaling bullish momentum.

- MACD neutrality suggests consolidation before potential breakout.

- News-driven sentiment and Bitcoin's rally support TRX's upside.

TRX Price Prediction

TRX Technical Analysis: Bullish Signals Emerge

TRX is currently trading at 0.35370000 USDT, above its 20-day moving average of 0.338160, indicating a bullish trend. The MACD histogram shows a slight bearish crossover but remains close to the zero line, suggesting potential for reversal. Bollinger Bands indicate the price is NEAR the upper band, signaling strong momentum. According to BTCC financial analyst Emma, 'TRX shows consolidation with a bullish bias, and a break above 0.361955 could target 0.4.'

Market Sentiment Turns Positive for TRX

Recent news highlights strategic Bitcoin acquisitions by Trump-backed firms and TRON's futures market neutrality, hinting at upside potential. BTCC financial analyst Emma notes, 'Healthy market conditions and record Bitcoin highs are creating a favorable environment for TRX. The futures market suggests a rally to $0.4 is plausible if bullish momentum sustains.'

Factors Influencing TRX’s Price

Trump-Backed American Bitcoin Targets Asian Firms for Strategic BTC Acquisitions

American Bitcoin, a mining venture backed by Donald Trump Jr. and Eric Trump, is actively pursuing acquisitions of Asian companies to expand its Bitcoin reserves. The firm is reportedly in talks to acquire a publicly listed Japanese company, with Hong Kong also under consideration.

The move mirrors the strategy of Michael Saylor's MicroStrategy, which holds over 600,000 BTC. American bitcoin aims to build a national crypto reserve, aligning with former President Trump's vision.

The company joins a growing list of firms adopting crypto treasury strategies, though its focus remains squarely on Bitcoin. Other players in the space diversify into Ethereum, Binance Coin, and TRON.

TRON Futures Market Shows Neutral Stance Amid Consolidation, Hinting at Potential Upside

TRON's price retreated to $0.355 after briefly surpassing $0.365, marking a 1.76% daily decline. This cooling-off period follows weeks of steady gains that spotlighted the network's transaction volume and derivatives activity.

CryptoQuant analyst Burak Kesmeci observes neutral positioning in TRX futures markets via the Volume Bubble Map, a tool that historically flags overheating when red bubbles emerge. The absence of such signals now suggests room for further appreciation before reaching speculative extremes.

The metric previously identified risk zones during TRON's December 2024 rally from $0.26 to $0.45. Current derivatives data indicates this uptrend may have legs—organic demand appears to be outpacing Leveraged speculation for now.

Crypto Market Reacts to Inflation Data as Bitcoin Hits Record High

Bitcoin briefly touched a historic peak of $124,128 before retreating 4% to $118,816, as July's hotter-than-expected inflation data triggered a market-wide pullback. Despite the dip, the milestone has fueled speculation that the post-halving rally may be imminent.

Altcoins like XRP, Litecoin, and Cardano are attracting capital alongside meme coins, with projects such as Pepe and Trump reaching new highs. Regulatory developments, including the GENIUS Act and the SEC's Project Crypto, are providing tailwinds for the sector.

Ripple's XRP surged to $3.65 following the GENIUS Act's enactment but has since corrected to $3.11, down 14.5% from its peak. The token's resilience during the downturn underscores its cross-border utility and regulatory clarity.

TRON Futures Signal Potential Rally to $0.4 Amid Healthy Market Conditions

TRON (TRX) exhibits bullish momentum, trading within an ascending channel over the past two months with measured pullbacks. The cryptocurrency currently sits at $0.357, reflecting a 2.12% daily dip, yet maintains a 19% monthly gain.

CryptoQuant analyst Burak Kesmeci highlights TRX's Futures Volume Bubble Map, which suggests room for further upside. The metric's neutral positioning contrasts with December 2024's overheated red-toned bubbles that preceded a surge from $0.26 to $0.45. This equilibrium indicates sustainable futures activity without excessive leverage.

Spot demand strengthens the case for a potential $0.4 test, though weakening long positions could trigger a retreat to $0.33. The absence of speculative froth in derivatives markets lends credibility to the upward trajectory.

How High Will TRX Price Go?

Based on technical and sentiment analysis, TRX could rally toward $0.4 if it sustains above the 20-day MA (0.338160). Key resistance lies at the Bollinger Upper Band (0.361955). Below is a summary of critical levels:

| Indicator | Value |

|---|---|

| Current Price | 0.35370000 USDT |

| 20-Day MA | 0.338160 |

| Bollinger Upper | 0.361955 |

| MACD Histogram | -0.002634 (Neutral) |

Emma emphasizes, 'A close above 0.362 could confirm the uptrend.'